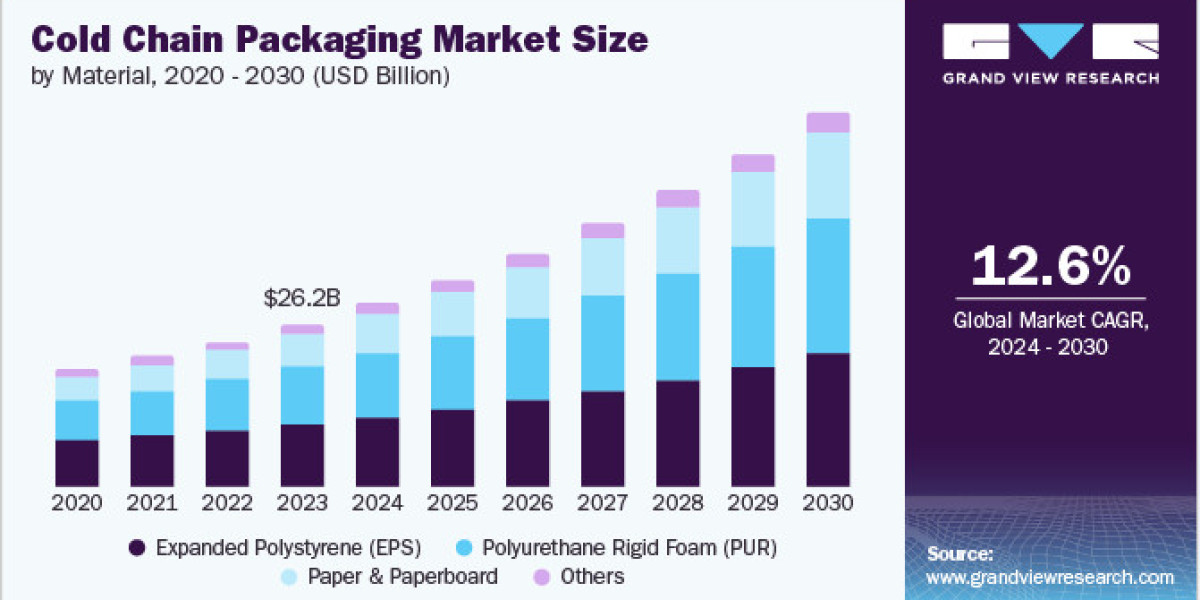

The global cold chain packaging market was valued at USD 26.17 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 12.6% from 2024 to 2030. This growth is primarily driven by increasing demand from the global food processing industry. Factors such as changing consumer lifestyles, population growth, and rapid urbanization are contributing to a rising need for convenient, processed food products. Items like frozen fruits and vegetables, dairy products, seafood, and meat are seeing high global demand, all of which require reliable packaging solutions to maintain quality during transport and storage.

Stringent food and safety regulations across various regions are significantly shaping the future of the temperature-controlled packaging industry. Governments have implemented numerous rules and guidelines for storing and transporting refrigerated goods. Key regulatory frameworks include the U.S. Food and Drug Administration’s standards for frozen foods, India’s Food Safety and Standards (Packaging) Regulations (2018), China’s Food Safety Law, and Canada’s Food and Drugs Act. Companies must comply with these regulations by adopting packaging solutions that meet specific temperature-control standards.

Material Insights

By material, the market is segmented into expanded polystyrene (EPS), polyurethane rigid foam (PUR), paper & paperboard, and others. EPS held the largest market share at 38.90% in 2023. Its dominance is attributed to its affordability and effective insulation properties, making it a cost-efficient option for companies seeking to balance performance with budget.

Product Insights

In terms of product type, the market includes insulated pallet shippers, insulated containers, vacuum insulated panels (VIPs), gel packs, and others. Insulated containers led the segment in 2023, capturing a 41.29% share. Their robust construction provides strong protection from physical damage during transport, helping maintain optimal temperatures and shielding contents from external environmental factors.

Get a preview of the latest developments in the Cold Chain Packaging Market! Download your FREE sample PDF today and explore key data and trends

End Use Insights

The market is categorized by end-use into fruits & vegetables, fruit & pulp concentrates, dairy products, fish, meat & seafood, processed food, pharmaceuticals, bakery & confectioneries, and others. Fish, meat, and seafood accounted for the largest share at 20.26% in 2023. This is largely due to the increasing export of meat products—such as beef and chicken—from countries like the U.S. and Brazil. Given the perishable nature of meat and its susceptibility to irreversible biochemical changes, maintaining frozen temperatures during storage and transit is essential.

Regional Insights

North America emerged as the leading region in the global cold chain packaging market, holding a 33.10% revenue share in 2023. The U.S., in particular, boasts a well-established healthcare and pharmaceutical sector. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA) 2023 report, North America accounted for 52.3% of global pharmaceutical sales, reinforcing the region’s significant demand for cold chain packaging, particularly for pharmaceutical applications.

Key Market Players

Major companies shaping the cold chain packaging market include:

Cold Chain Technologies

Cryopak

Sonoco ThermoSafe

SOFRIGAM

Softbox Systems Ltd

Pelican Products, Inc.

CSafe

TOWER Cold Chain Solutions

Sealed Air Corporation

CoolPac

Nordic Cold Chain Solutions

Global Cooling Inc.

Inmark LLC

Envirotainer AB

DGP Intelsius LLC

Vericool, Inc.

Emballages Cre-O-Pack Intl

TemperPack Technologies, Inc.

Gather more insights about the market drivers, restrains and growth of the Cold Chain Packaging Market