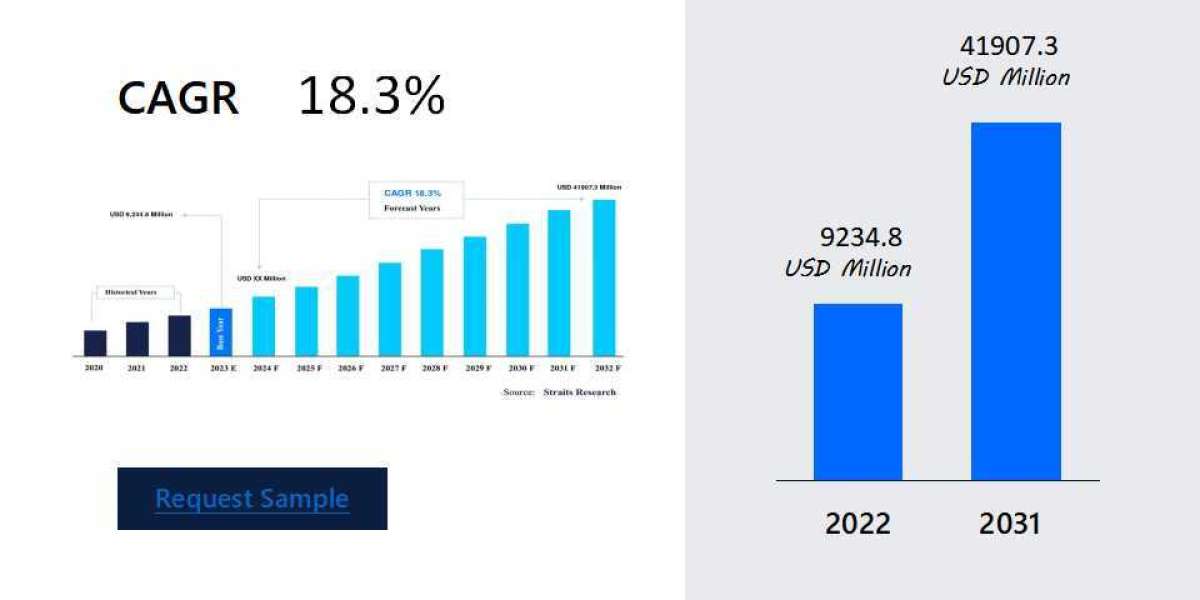

The GCC Luxury Residential Real Estate Market is poised for significant growth, projected to expand from approximately USD 176.29 billion in 2024 to USD 215 billion by 2030. This forecasted growth represents a compound annual growth rate (CAGR) of around 2.98%. The escalating demand for high-end living options, driven by affluent consumers seeking luxury amenities and services, underlines the market's resilience and attractiveness to investors.

Key Driver

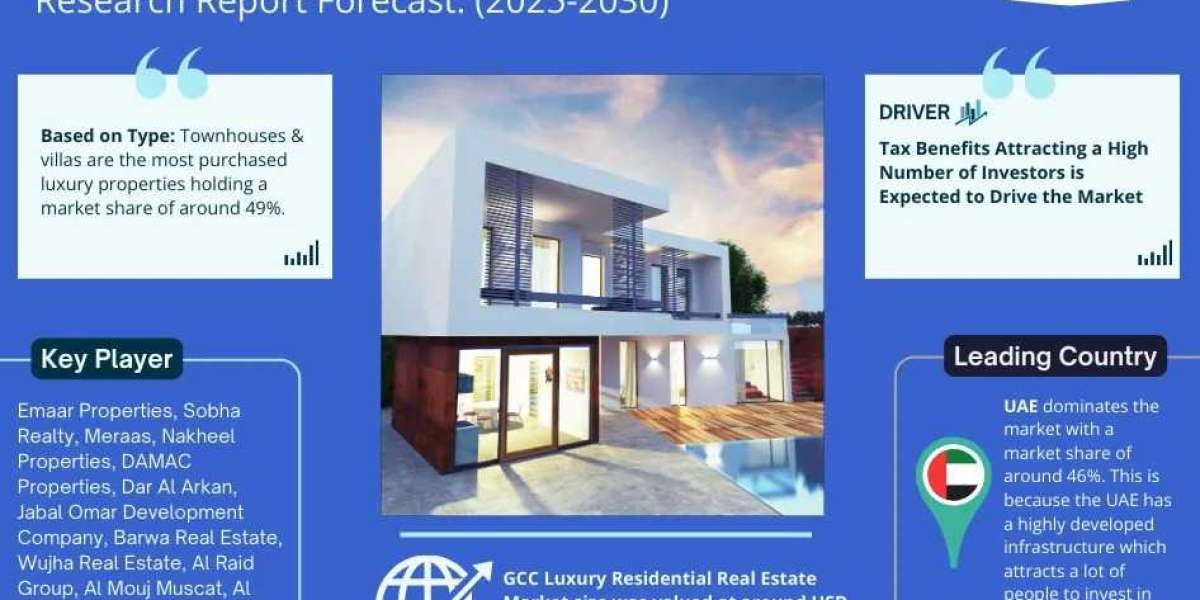

The GCC luxury residential real estate market is primarily driven by favorable tax policies that attract both local and foreign investors. The absence of property taxes in countries like the UAE, Oman, and Kuwait, combined with minimal transfer taxes in Saudi Arabia and Bahrain, creates a unique investment environment. This tax advantage significantly incentivizes high-net-worth individuals (HNWI) and expatriates to invest in luxury real estate, further pushing market growth. Additionally, the economic diversification in GCC countries enhances the appeal of luxury properties, as regions like Dubai and Doha increasingly become international business hubs, attracting wealthy individuals seeking high-quality living.

Download Free Sample PDF – https://www.marknteladvisors.com/query/request-sample/gcc-luxury-residential-real-estate-market.html

GCC Luxury Residential Real Estate Market Segmentation Analysis

By Type

- Flats Apartments

- Condominiums

- Penthouses

- Townhouses Villas (Dominating Segment): Townhouses and villas account for approximately 49% of the market share. They are preferred for their spacious nature, private amenities, and high-end finishes, appealing to affluent families seeking privacy and a lifestyle of luxury.

By Configuration

- 1-2 Bedrooms (BHK)

- 3-4 Bedrooms (BHK)

- 5-6 Bedrooms (BHK): The 5-6 bedroom segment leads the configuration category, capturing around 58% due to spaciousness catering to families.

By Furnishing

- Fully-Furnished

- Semi-Furnished

By Size

- Less than 5,000 sq. ft.

- 5,000 – 10,000 sq. ft.

- 10,000 – 15,000 sq. ft.

- 15,000 – 20,000 sq. ft.

- Above 20,000 sq. ft.

By Price

- 1 – 5 (USD Millions)

- 5 – 10 (USD Millions)

- 10 – 20 (USD Millions)

- 20 – 50 (USD Millions)

- 50 – 100 (USD Millions)

- Above 100 (USD Millions)

View Full Report - https://www.marknteladvisors.com/research-library/gcc-luxury-residential-real-estate-market.html

Country Insights

The GCC region covers the UAE, Saudi Arabia, Qatar, Kuwait, Oman, and Bahrain. Among these, the UAE leads with a market share of approximately 46%, driven by its high disposable income population, modern infrastructure, and favorable taxation policies.

Key players in the GCC luxury residential real estate market include:

- Emaar Properties

- Sobha Realty

- Meraas

- Nakheel Properties

- DAMAC Properties

- Dar Al Arkan

- Jabal Omar Development Company

- Barwa Real Estate

Frequently Asked Questions

- What factors are expected to drive growth in the GCC luxury residential real estate market during 2025-2030?

- How do tax policies in the GCC influence luxury property investment trends?

- Which segment of the luxury residential market is projected to dominate in the coming years?

- What are the anticipated challenges facing investors in the GCC luxury real estate market?

- Which countries in the GCC are expected to show the most growth in luxury property sales by 2030?

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel, and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address

Brose More Residential Real Estate Market Report:

- Luxury Residential Real Estate Market Report By MarkNtel - View Report

- Buildings, Construction Report List MarkNtel - View Report

About US:

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative quantitative research company, strive to deliver data to a substantial varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

For Media Inquiries, Please Contact:

Phone: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India