Download Free Sample : https://straitsresearch.com/report/digital-money-transfer-and-remittance-market/request-sample

Digital Money Transfer and Remittance Market Catalysts for Expansion

Several key factors are driving the growth of the Digital Money Transfer and Remittance Market:

Rising Demand for Cross-Border Payments: The increasing globalization and mobility of the workforce are driving the demand for secure and efficient cross-border money transfer services.

Advancements in Digital Technology: Continuous advancements in digital technology, including blockchain and mobile banking, are enhancing the efficiency and security of digital money transfers.

Increased Internet and Smartphone Penetration: The growing penetration of the internet and smartphones is facilitating the adoption of digital money transfer services, particularly in emerging markets.

Government Initiatives: Government initiatives and policies aimed at promoting financial inclusion and reducing the cost of remittances are supporting market growth.

Convenience and Speed: The convenience, speed, and cost-effectiveness of digital money transfer services are attracting consumers and businesses alike.

Digital Money Transfer and Remittance Market Segment Breakdown

Leading Companies

Western Union Holdings Inc.

Euronet Worldwide Inc.

PayPal (Xoom)

MoneyGram International

OrbitRemit

Infibeam Avenues Limited (IAL)

FlyRemit

Digital Wallet Corporation (Smiles)

VayuPay

ControlBox Corp.

Rootways Inc.

Cyrus

Among others

Top Performing Companies

By Type

Domestic Remittance: Money transfers within the same country, typically used for paying bills and sending money to family members.

International Remittance: Cross-border money transfers used for supporting family members abroad, paying for services, and conducting business transactions.

By Application

Business Remittance: Money transfers used by businesses for paying suppliers, employees, and other business-related expenses.

Personal Remittance: Money transfers used by individuals for personal reasons, such as sending money to family members and paying for personal expenses.

Public Services Remittance: Money transfers used for paying for public services, such as utilities, taxes, and government fees.

By Sales Channel

Banks: Traditional financial institutions offering digital money transfer services through online and mobile banking platforms.

Money Transfer Operators: Specialized companies providing money transfer services, such as Western Union and MoneyGram.

Online Platforms: Digital platforms and mobile apps offering money transfer services, such as PayPal (Xoom) and FlyRemit.

Others: Other channels, including post offices and retail stores, offering money transfer services.

Digital Money Transfer and Remittance Market Emerging Prospects

The Digital Money Transfer and Remittance Market presents numerous emerging prospects:

Expansion into Emerging Markets: The increasing internet penetration and mobile phone adoption in emerging markets offer significant growth opportunities for digital money transfer service providers.

Integration with Blockchain Technology: The integration of blockchain technology is enhancing the security and transparency of digital money transfers, reducing the risk of fraud and errors.

Development of Mobile Wallets: The growing adoption of mobile wallets is driving the demand for digital money transfer services, providing users with convenient and secure payment options.

Focus on Financial Inclusion: Efforts to promote financial inclusion and provide banking services to the unbanked population are creating opportunities for digital money transfer service providers.

Customization and Personalization: Developing customized and personalized money transfer solutions to meet the specific needs of different customer segments can drive market growth.

Digital Money Transfer and Remittance Market Industry Movements

The Digital Money Transfer and Remittance Market is witnessing several industry movements:

Strategic Partnerships and Collaborations: Leading companies are forming strategic partnerships and collaborations to expand their service offerings and reach new markets.

Investment in Technology: Increased investment in technology, including AI and blockchain, is enhancing the efficiency and security of digital money transfer services.

Regulatory Compliance: Companies are focusing on regulatory compliance to ensure the security and legality of their services, particularly in cross-border transactions.

Customer-Centric Approach: A growing emphasis on customer satisfaction and experience is driving the development of user-friendly and intuitive digital money transfer platforms.

Sustainability Initiatives: Companies are implementing sustainability initiatives to reduce their environmental impact and promote social responsibility.

Digital Money Transfer and Remittance Market Geographic Analysis

The Digital Money Transfer and Remittance Market is analyzed across various geographic regions:

North America: Leading the market with a strong focus on technological innovation and financial inclusion. The United States and Canada are the dominant countries in this region.

Europe: Significant growth driven by the adoption of digital payment solutions and cross-border money transfers. The United Kingdom, Germany, and France are leading the market in this region.

Asia-Pacific: Rapid expansion due to increasing internet penetration, mobile phone adoption, and cross-border remittances. China, India, and Japan are the dominant countries in this region.

Latin America, Middle East, and Africa (LAMEA): Growing adoption of digital money transfer services driven by financial inclusion initiatives and economic development. Brazil, South Africa, and the UAE are leading the market in this region.

Digital Money Transfer and Remittance Market Data Insights

The Digital Money Transfer and Remittance Market is supported by comprehensive data insights:

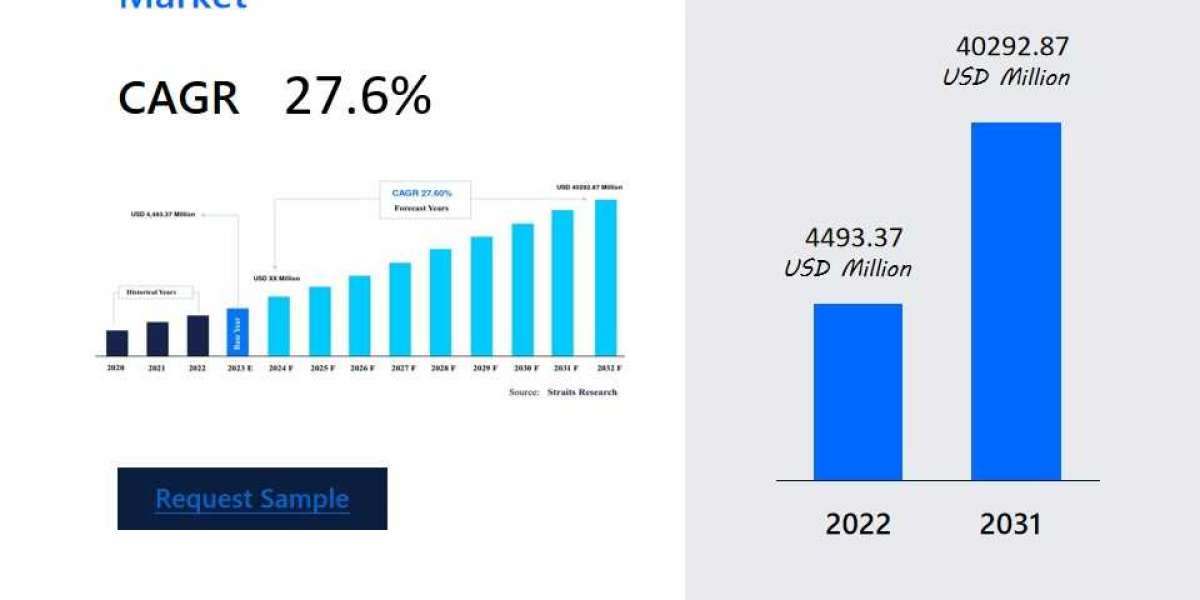

Market Size and Forecast: Detailed analysis of the market size and growth projections for the forecast period.

Market Share Analysis: Insights into the market share of leading companies and their competitive positioning.

Customer Segmentation: Analysis of customer segments and their preferences for digital money transfer services.

Technology Trends: Overview of the latest technology trends shaping the digital money transfer market.

Regional Analysis: In-depth analysis of market trends and opportunities in different geographic regions.

Buy Now : https://straitsresearch.com/buy-now/digital-money-transfer-and-remittance-market

Conclusion

The Digital Money Transfer and Remittance Market is poised for significant growth, driven by technological advancements, increasing demand for cross-border payments, and the focus on financial inclusion. With numerous opportunities for innovation and expansion, the market is set to transform the landscape of money transfers, offering scalable, flexible, and efficient solutions for individuals and businesses alike.

About Straits Research

Straits Research is a premier research and intelligence provider, offering detailed market reports, analytics, and advisory services to empower clients in making informed business decisions. With a team of experienced researchers and analysts, Straits Research delivers tailored insights and actionable data to support the strategic goals of our clients worldwide.

Contact Us

For more information about the Digital Money Transfer and Remittance Market Report, please contact:

Email: sales@straitsresearch.com Address: 825 3rd Avenue, New York, NY, USA, 10022 Phone: +1 646 905 0080 (US), +91 8087085354 (India), +44 203 695 0070 (UK)