The global emission monitoring systems market size was valued at USD 3.50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% from 2024 to 2030. The growth can be attributed to advancements in sensor technologies, data analytics, and remote monitoring capabilities that have significantly enhanced the functionality and efficiency of emission monitoring systems. Improved accuracy, reliability, and real-time data availability are driving the adoption of these systems. Emission monitoring systems (EMS) provide real-time data and analytics that enable organizations to identify areas of excessive emissions, energy waste, and process inefficiencies. Companies can enhance their overall operational efficiency and reduce costs by optimizing operations, reducing emissions, and minimizing energy consumption.

Moreover, the demand for these systems is significantly driven by stringent environmental regulations enforced by governments and regulatory bodies, including the United States Environmental Protection Agency (EPA), European Union Industrial Emissions Directive (IED), and National Environmental Laws and Regulations in Canada, among others. Industries are compelled by environmental regulatory authorities to implement EMS to track the release of pollutants.

Type Insights

The CEMS segment led the market and held more than 79% share of the global revenue in 2023 and is projected to grow at the fastest CAGR of 10.3% during the forecast period. Based on type, the EMS market is bifurcated into continuous emission monitoring system (CEMS) and predictive emission monitoring system (PEMS). CEMS provides accurate and real-time data on emissions, enabling industries to monitor and track their pollutant levels continuously.CEMS encompasses a range of activities focused on identifying and reporting pollutant emissions from stationary sources to the atmosphere. Various industries, including coal-fired power plants, biomass power plants, oil-fired power plants, kraft pulp mills, waste incinerators, and cement plants, are required by regulatory authorities to continuously monitor their emissions, implement emission control measures, and provide ongoing documentation of their emissions to local environmental control agencies.

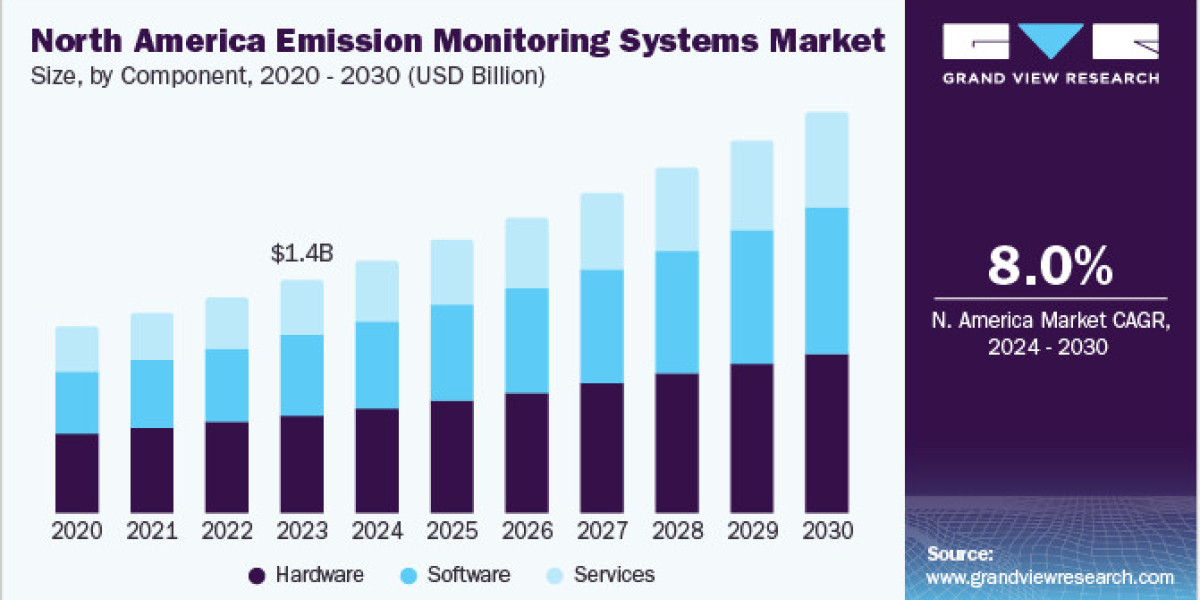

Component Insights

Based on component, the hardware segment led the market and held more than 56% share of the global revenue in 2023. The EMS market is bifurcated into hardware, software, and services. The hardware components work together to enable the continuous monitoring, measurement, and recording of emissions from stationary sources, providing accurate and reliable data for regulatory compliance and environmental management purposes. The hardware components in EMS include sensors, gas analyzers, opacity &, particulate matter monitors, sampling systems, control units, and data acquisition systems, among others. These devices are used to measure and quantify pollutant concentrations in the emissions.

Get a preview of the latest developments in the Emission Monitoring Systems Market! Download your FREE sample PDF today and explore key data and trends

End-use Insights

In terms of end-use, the oil & gas segment led the market and held more than 26% share of the global revenue in 2023. Based on the end-use segment, the market is bifurcated into oil & gas, metals & mining, power generation, chemical & fertilizers, pulp & paper, pharmaceuticals, and others. Oil and gas companies utilize EMS to comply with regulations, demonstrate environmental responsibility, reduce costs, and optimize operations. Emission monitoring plays a crucial role in ensuring compliance with environmental regulations and minimizing the environmental impact of operations. Oil and gas companies utilize various technologies and strategies with EMS to achieve this. One primary application of these systems is the measurement and control of greenhouse gas emissions, including carbon dioxide (CO2), methane (CH4), and other volatile organic compounds (VOCs). These systems allow companies to accurately track and quantify their emissions, identifying sources of pollutants and implementing targeted emission reduction measures.

Regional Insights

North America led the overall market in 2023, with a share of more than 31.0% in terms of revenue. The growth is driven by a robust and dynamic economy, that is remarkable for its thriving industries such as manufacturing, technology, finance, and healthcare. The region's economic growth fuels demand for a wide range of products and services, fostering market expansion and driving innovation. Moreover, the region benefits from a thriving ecosystem that nurtures entrepreneurship, startups, and innovation. Moreover, government regulations and policies play a significant role in shaping the North American market. Regulatory frameworks prioritizing fair competition, consumer protection, and environmental sustainability create a favorable business environment. In addition, sector-specific regulations in energy, healthcare, and finance profoundly impact market dynamics and drive the demand for solutions that comply with these regulations. Clean Air Act, Clean Water Act, National Ambient Air Quality Standards, and National Pollutant Release Inventory are a few environmental regulations in the region.

Key Emission Monitoring Systems Companies:

The following are the leading companies in the emission monitoring systems market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these emission monitoring systems companies are analyzed to map the supply network.

- ABB Ltd.

- Ametek, Inc.

- Emerson Electric Company

- General Electric Company

- Enviro Technology Services Plc.

- Horiba Ltd.

- Fuji Electric Co., Ltd.

- Rockwell Automation, Inc.

- Siemens AG

- Thermo Fisher Scientific Inc.

Gather more insights about the market drivers, restrains and growth of the Emission Monitoring Systems Market